Banking & Payments Federation Ireland

The voice of banking and payments in Ireland

News & Resources

View our latest published content, or search our archives using the search below.

Uncategorized

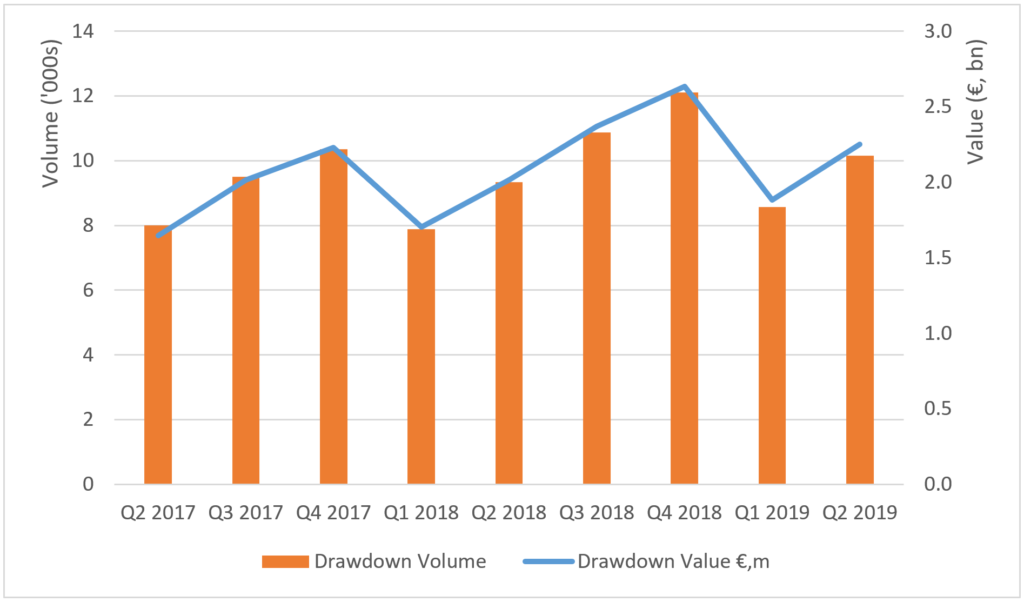

BPFI figures show good growth in mortgage drawdown activity as well as in approvals activity

Read More »

24 July, 2019

© 2024 Banking & Payments Federation Ireland. All rights reserved.

Website by create.ie