Banking & Payments Federation Ireland

The voice of banking and payments in Ireland

News & Resources

View our latest published content, or search our archives using the search below.

Uncategorized

Older Irish people losing almost six times more money to scammers than younger generation – FraudSMART Survey

Read More »

23 September, 2019

Uncategorized

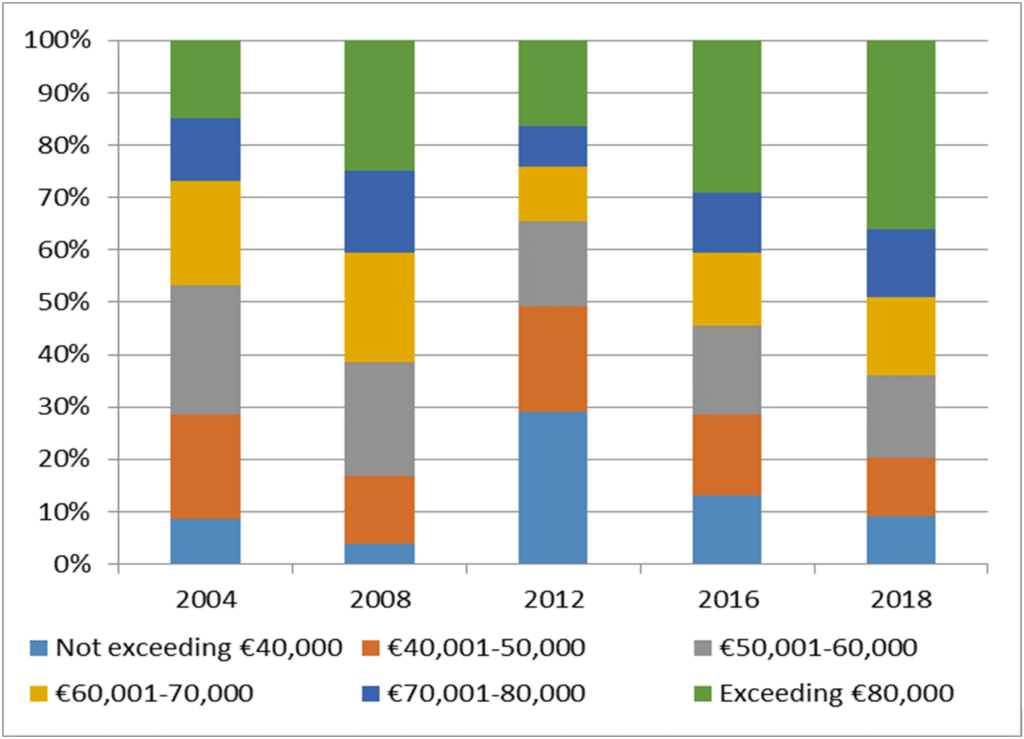

Household incomes struggle to finance accommodation as housing costs approach previous peaks – BPFI Housing Market Monitor

Read More »

11 September, 2019

© 2024 Banking & Payments Federation Ireland. All rights reserved.

Website by create.ie