-

76% of consumers use contactless payments at least weekly

-

77% of bank customers using online/mobile banking to access accounts at least weekly versus 12% who do so in branch

-

64% of bank customers use branches less than once a month or never

The COVID-19 pandemic is fast-tracking the shift from cash to digital payments as well as accelerating the move from branch to online banking according to the latest payments research published today by Banking & Payments Federation Ireland (BPFI).

Outlining the key takeaways from the findings, BPFI Chief Executive Brian Hayes explained: “The transformation in the banking and payments landscape that was already underway is being accelerated by Covid-19 as consumers fast change their behaviour towards technology and move away from traditional banking and payments activities Our latest payments research which was conducted at the end of April during the lockdown period shows that the current pandemic is undoubtedly fuelling a change in consumers behaviour toward digital payments and online banking and away from branches.”

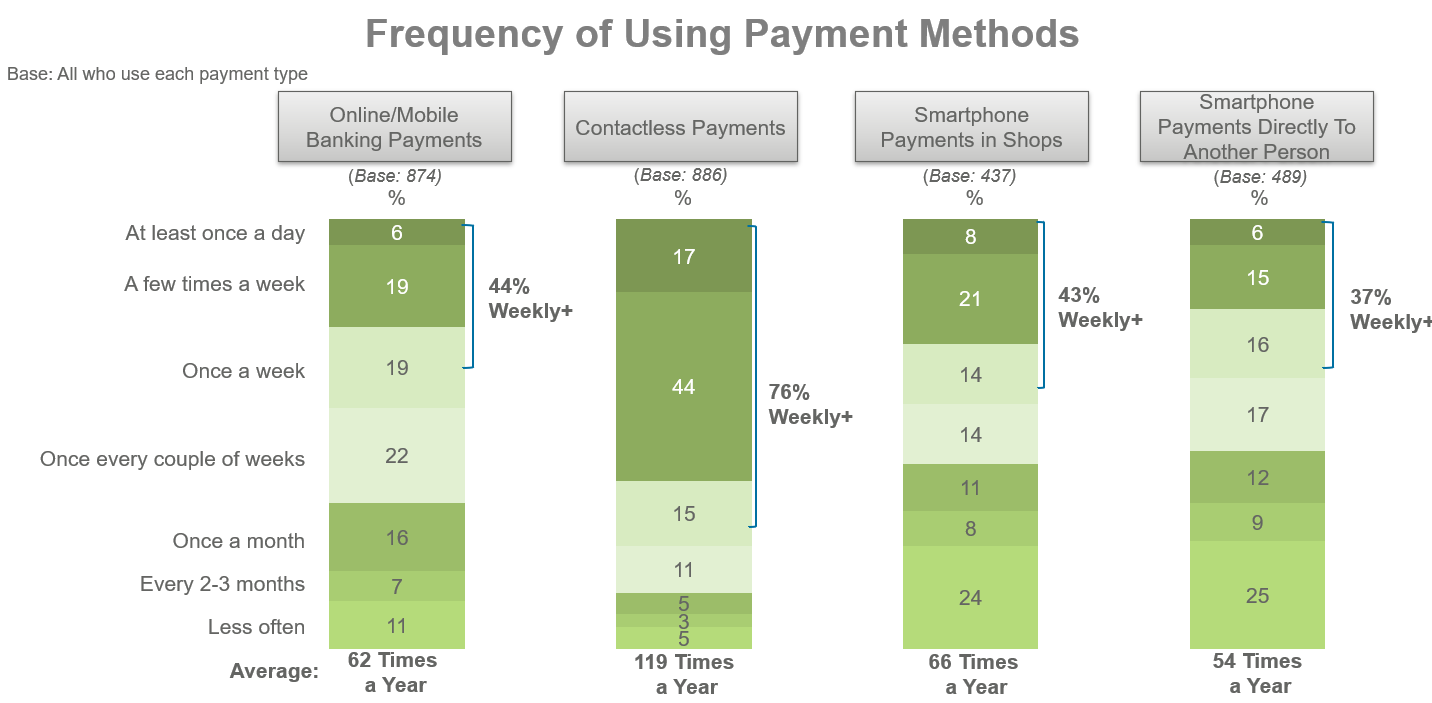

Adoptions rates of digital payments and banking across the generations

“A total of 92% of all adults have now used contactless payments and 76% of consumers say they are using it on at least a weekly basis. Payments through smartphones are a fast-growing feature of shopping in Ireland particularly among 18-24 year olds who are the biggest adopters of this technology. A total of 43% of consumers are using their smartphones in shops at least weekly, while 44% of consumers are making payments via online/mobile banking with the same frequency. These are significant numbers and interestingly we are seeing the increase in adoption rates right across the generations. And while in the current environment some of this behaviour is being driven by hygiene concerns in terms of using contactless, and by necessity in terms of paying online, it ultimately means that we can expect an acceleration in the rate of adoption of these technologies as we move into a post-COVID landscape.”

Cash withdrawals down 56%

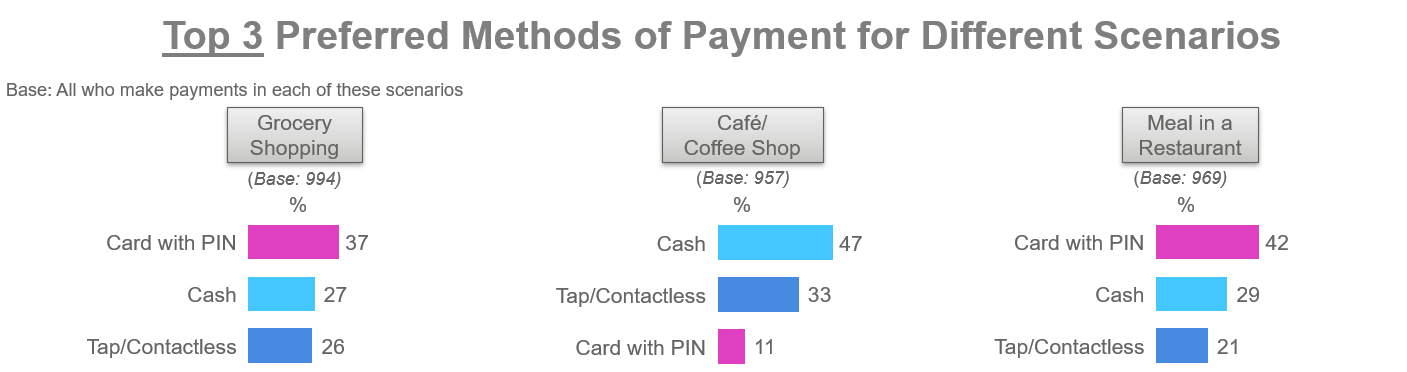

With the increased emphasis on contact-free and online payments due to COVID there has been a sharp drop in cash withdrawals which are less than half of normal levels. And while cash is still a preferred choice for many consumers it is being out performed by card, contactless and smartphone payments. The research shows that when shopping for groceries 63% of consumers preferred to use a card with a pin or a contactless card compared to 27% who preferred to use cash. And while 47% of people said they preferred to pay in cash when at a café/coffee shop, 50% expressed a preference for a card, smartphone or mobile payment option.

Bank branches on the decline as online banking grows

Changes in how we bank post-COVID are also evident from the research which shows that up to 17% of people expect to use their bank branch less once the COVID restrictions have been lifted. This is underlined by the increasing gap illustrated in the research between online and branch banking with up to 77% of bank customers using online and mobile banking to access their account on at least a weekly basis compared to 12% who do so in their branch. A total of 64% of those surveyed said they used their branch less than once or month or never to access their bank account.

Evaluating the trends demonstrated by the research Mr Hayes added: “The impact of COVID-19 has accelerated trends that we have been seeing emerge for many years with a significant uplift in the use of digital channels and electronic payments. While many consumers had already embraced new and innovative electronic payment methods, COVID-19 has resulted in a societal shift towards electronic payment options. As COVID-19 is likely to be with us for some time to come it is likely that the changes in consumer behaviour will remain and drive long-lasting reduction in the volumes of paper based options such as cash and cheque. However, the choice will always remain with the consumer. It will certainly be interesting to watch the trends further evolve as economies start to reopen.”

Editor’s Note: BPFI commissioned Coyne Research to survey a nationally representative sample of 1,000 Irish adults online between the 22nd – 28th April 2020. Cash withdrawals data is based on BPFI analysis of Central Bank of Ireland data on card usage.

Notes: Banking & Payments Federation Ireland (BPFI) represents the banking, payments and fintech sector in Ireland. Together with its affiliates, the Federation of International Banks in Ireland and the Fintech & Payments Association of Ireland, BPFI has some 100 member institutions and associates, including licensed domestic and foreign banks and institutions operating in the financial marketplace here.

Contact: Jillian Heffernan, Head of Communications, 087 9016880 or jillian.heffernan@bpfi.ie