Consumers warned to make purchases using only secure websites

FraudSMART, a fraud awareness initiative led by Banking & Payments Federation Ireland (BPFI) and supported by An Garda Síochána, have issued a strong warning to thousands of consumers to be extra cautious in their online activity on Black Friday and Cyber Monday and to make purchases using only secure websites, where ‘https’ and a padlock symbol are on display.

Olivia Buckley, Head of Fraud Prevention FraudSMART, said well over €4 billion is expected to be spent online with payment cards throughout November and December. “Almost €12 billion was spent using cards between November and December last year, with well over €4 billion of that spend accounted for by e-commerce. Purchasing online is growing amongst Irish consumers; €41.3bn of purchases were made with cards in the first nine months of this year alone with some €20.1bn of that spending carried out online, almost double the amount for the same period in 2015.”

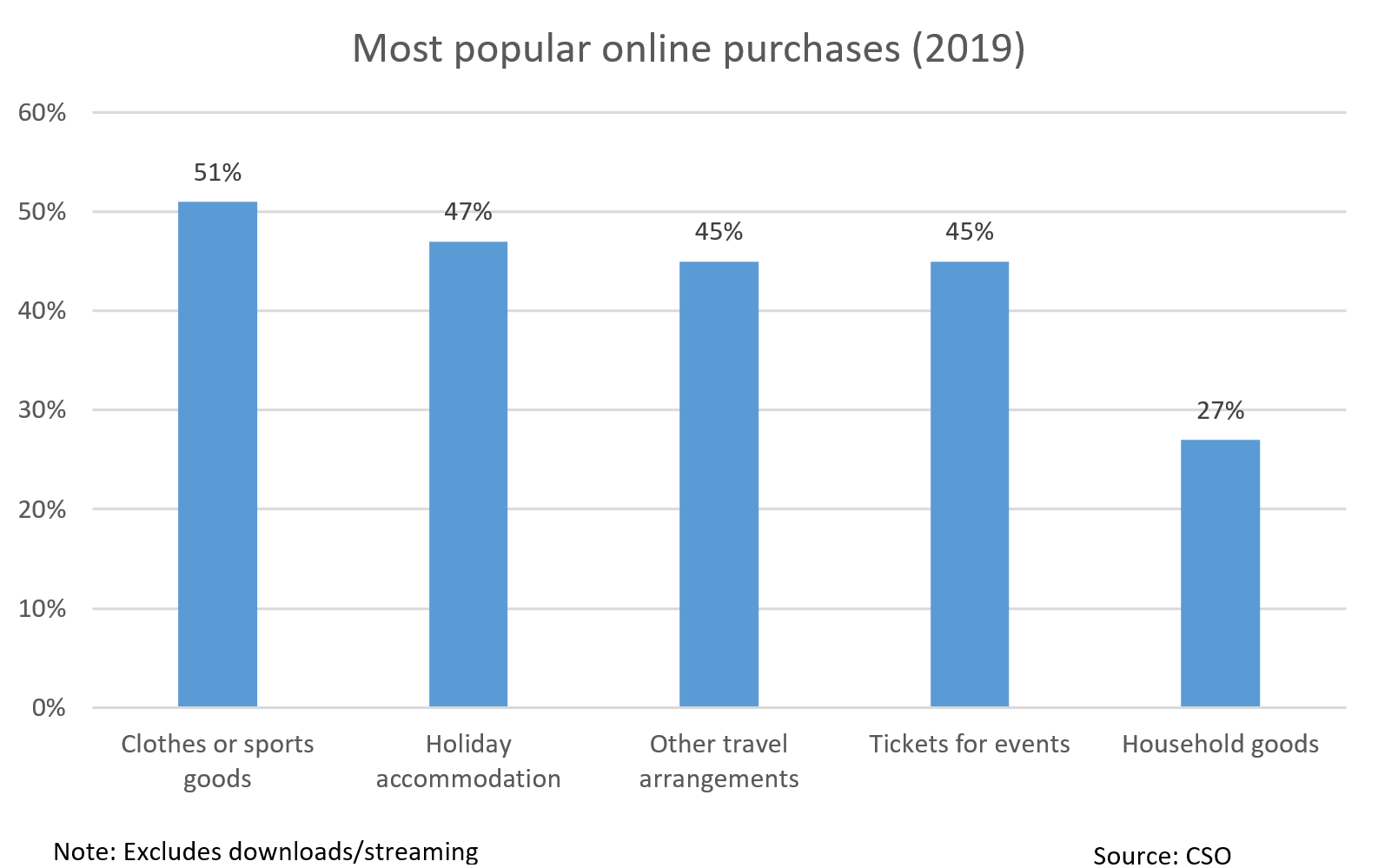

Ms. Buckley also said: “In the region of 75% of all card fraud occurs online, so serious caution is required when purchasing goods or services. The large volumes of online purchases expected to be made this week means fraudsters will be attempting to lure consumers into fraudulent websites, while posing as authentic suppliers. The most popular goods purchased online are clothes and sportswear, along with household goods”.

Detective Chief Superintendent Pat Lordan of the Garda National Economic Crime Bureau said “As the pre-Christmas rush draws thousands of shoppers online, we urge that people be aware of the potential for fraud, whether they are buying or selling a product. People should be particularly careful when high value products are offered at prices significantly under market value and when there is a demand for payment in advance to a person or entity that are not known or not clearly identifiable”.

FraudSMART and An Garda Síochána said there are some critical pieces of advice that consumers must follow to help protect their finances and their bank account.

- Use secure websites. The website address should be ‘https’ before the purchase is made, indicating a secure connection

- Use sites where a padlock symbol is shown beside the website address

- Do not under any circumstances use public Wi-Fi when making payments – switch to 3G/4G on your phone if necessary

- Independently visit the website of the online sales company as opposed to clicking on social media or pop-up adverts

- Be cautious about claiming outrageous offers – if it sounds too good to be true it probably is

- Stick to well-known websites or websites that you are familiar with or websites associated with high street retail outlets

Consumers can get advice on how to avoid fraud by visiting www.FraudSMART.ie

For further information

Olivia Buckley, Head of Fraud Prevention, FraudSMART, Banking & Payments Federation Ireland.

Tel: 00 353 87 6298113 Email: Olivia.buckley@bpfi.ie

Notes to Editor

The following are the most common fraud scams by which criminals can obtain payment card details.

Phishing is where criminals send unsolicited emails to individuals which purport to have been sent from genuine businesses or individuals. The purpose of these emails is to induce the individuals to reveal personal information such as payment card details, bank account numbers and personal security data. Phishing emails usually appear to have been sent from financial institutions and instruct the recipient to follow a link to a fraudulent website which requests personal and financial information be inputted.

Vishing or Voice Phishing is the criminal practice of using social engineering techniques over the phone in order to obtain the personal, financial or security data from individuals. Social engineering can be described as human to human interaction which attempts to exploit vulnerabilities in human nature in an attempt to obtain personal information.

Smishing or SMS Phishing is a phishing attack whereby a mobile phone user receives an SMS (text) message which purports to have been sent from a genuine business or individual. This message attempts to induce the recipient to follow a link to a website which appears to be legitimate but in under the control of the criminal organisation. This website then requests personal and financial information to be inputted.